The South China Morning Post, one of the continent’s premiere English newspapers, has an article out this week via Bloomberg on the Yuan’s (CNY) value against the US Dollar (USD) over the next 12 – 15 months. Why should you care?

Key Take Away: Businesses and consumers should brace for price increases from China-made products beginning in December ’18 or January ’19. However, many believe that those costs will back off by mid-year.

First, the US imports so much from China that changes in the exchange rate will make a real difference in the pocketbooks of both consumers and businesses. A stronger Chinese currency (less Chinese dollars for an American dollar) makes it cheaper for people to buy things with USD and vice versa. For years, China pegged the value of the CNY against the USD and did not allow the market to dictate it’s value. The Brookings Insitute has an excellent history here. Today, the Chinese government allows it to “float” but only within parameters that they set, and can change.

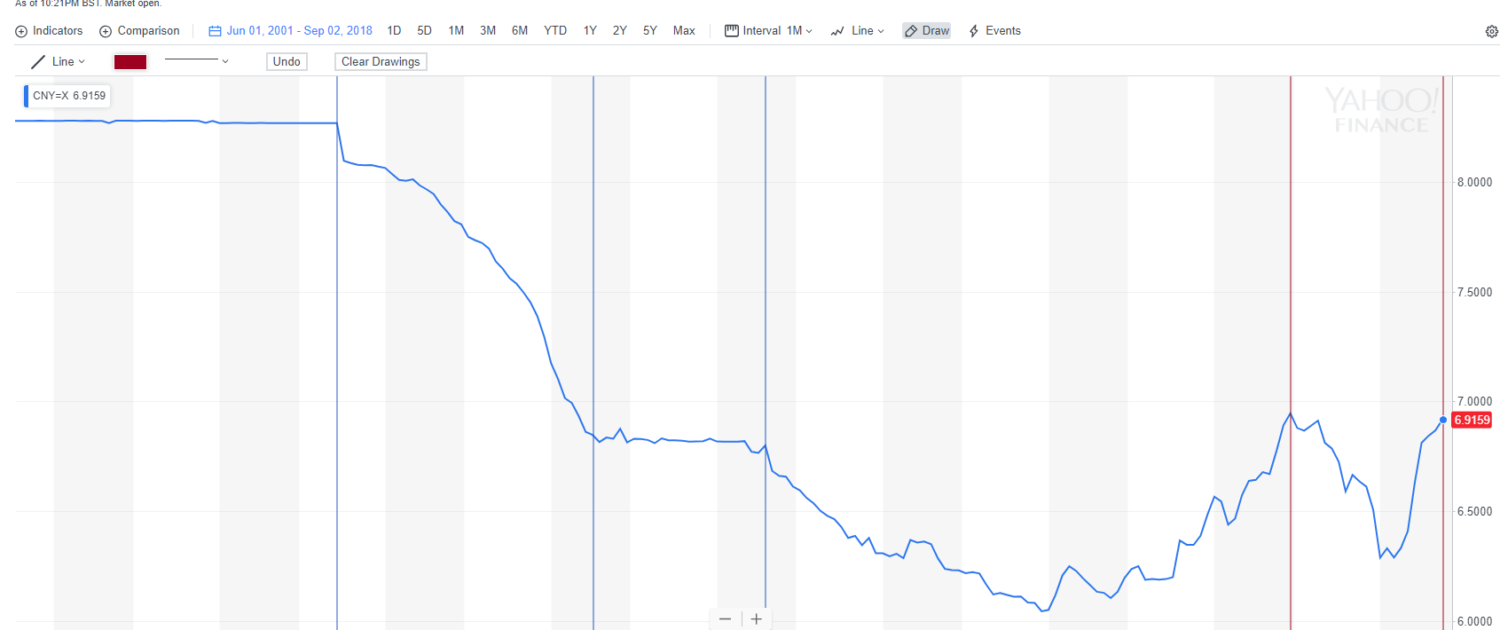

A majority of people in the article expected the CNY to come down to less than 7 CNY/USD, but not until mid-2019. For comparison, see the chart below from Yahoo Finance. Please note, that a higher CNY value is a weaker Chinese dollar in this chart. The vertical blue lines show changes in the CNY float, the red markers show December 2016 and October 2018.

For years $1USD bought 8 CNY. From 2005 to 2008 the CNY increased to just under $1USD = 7 CNY, which is also about where it stood in December of 2016. After appreciating against the dollar for a year, it began a rapid depreciation from January of 2018 through now. From 6.2 to 6.9 today. The result of that decline is to almost perfectly offset the 10% tariffs that the American government levied on Chinese goods. I.e., the US is taxing those goods at 10% but the real cost of those goods also fell by 10%, effectively making the tariffs a wash.

However, in January a second round of tariffs goes into effect at 25%. If the South China Morning Post is correct the Chinese government won’t offset it by allowing for a weaker CNY, at least not right away. The result is both businesses and consumers should brace for prices increases from China-made products beginning in December or January. However, many believe that those costs will back off by mid-year.

One more side effect: The tariffs don’t target all Chinese products, consumer electronics such as iPhones are currently exempt. For those goods, the price will come down. However, you can expect Apple and other companies to pocket that difference, especially as they’ll still be paying more on the commercial equipment they import from China.

We’ll have a more in-depth post out on tariffs, exchange rates and your business soon.

Download our Report!

Get your copy of What Every Business Owner Must Know About Hiring an Honest, Competent, Responsive, and Fairly-Priced Computer Consultant.